A Bigger Splash, David Hockney • Credit below.

Setting up an LLC business doesn't take much time! ….That is, if you know what to do, what you need, and the right order of steps. Here's where I've got you covered.

(Not sure if you want an LLC? Read Sole Proprietor or LLC: Which is Best for Me?)

Below is the quick and dirty list. Detailed notes are at the bottom of the post.

If you know your business name(s), the whole process takes about one hour.

Go ahead, take the plunge!

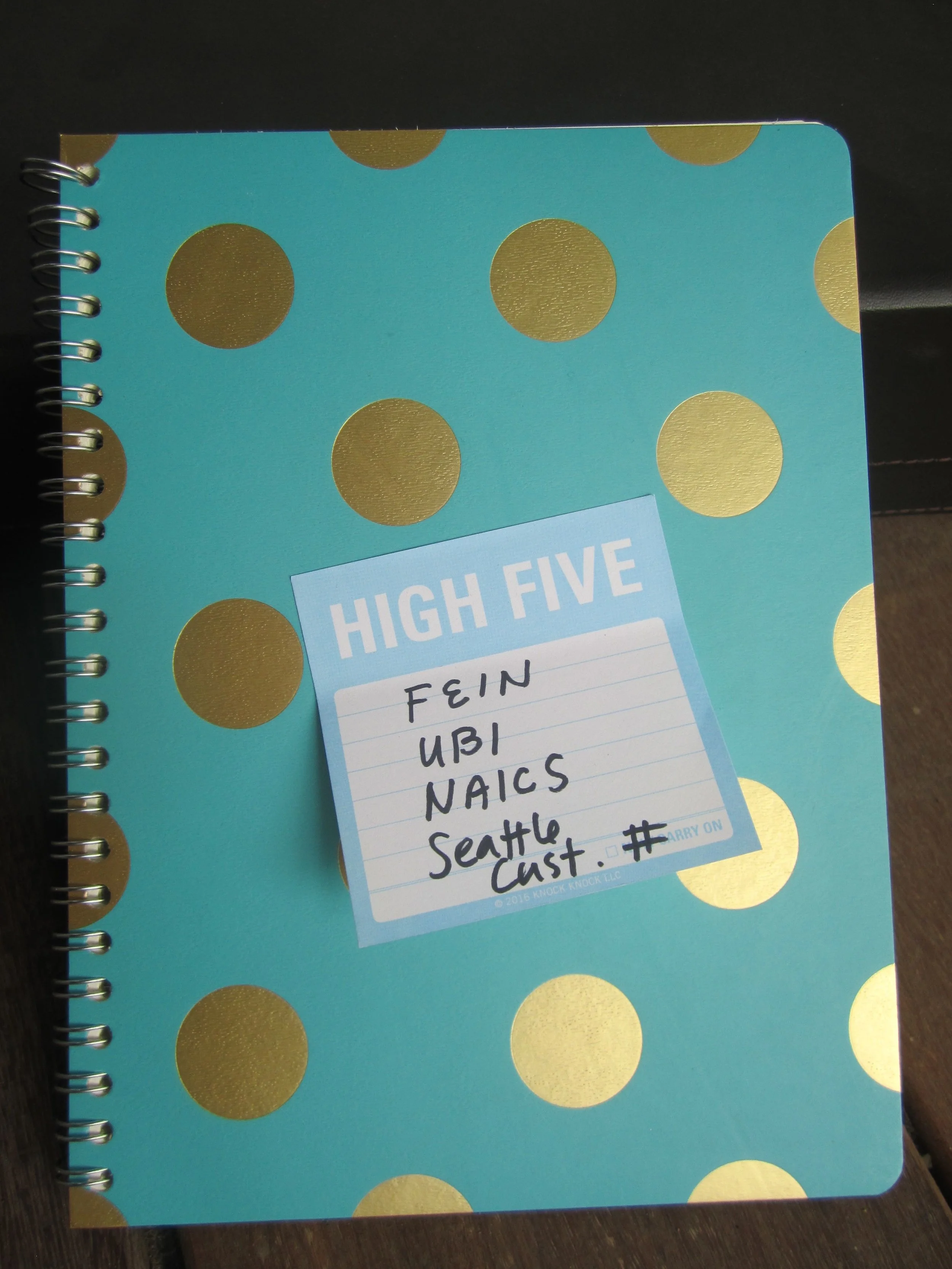

Pro Tip: Get a journal to record all your log-ins, passwords, IDs, and various notes as you go through the process. Use in the future for all research and calls related to taxes and licensing.

1) Register your LLC / PLLC.

Through: the Washington Secretary of State

Click here to go directly to registration.

Cost: $200

Time: 10 minutes

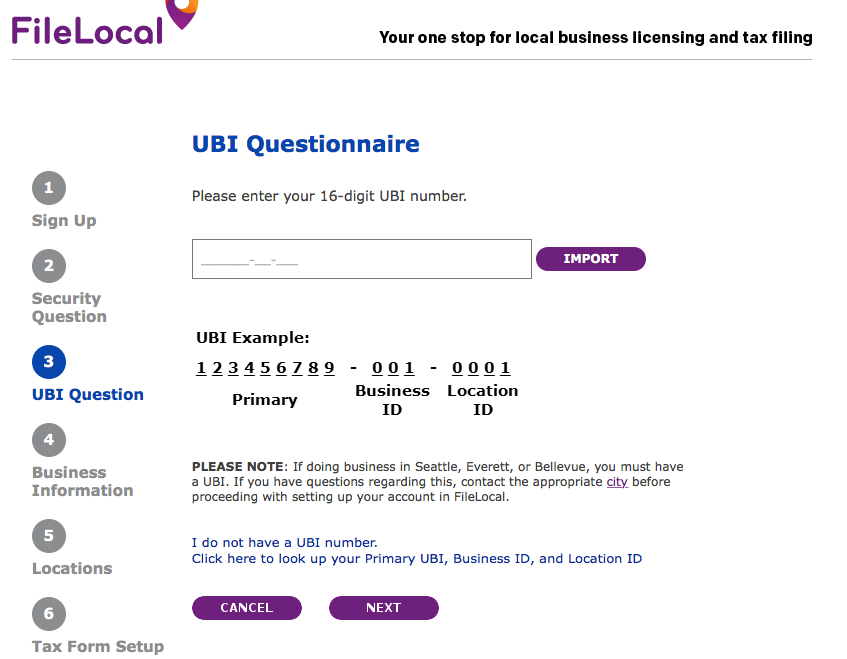

2) Pause + wait for your UBI

You'll need your UBI to go on to the next steps. (Unified Business Identifier.) It's a lot like your social security number, in that it's a tax ID number assigned to you ... and banks and other organizations will ask for it to identify you. It'll be provided along with your LLC documents. Most often, it's in a 9 digit format. Sometimes it'll be in a 16 digit format, where there are 0s and 1s at the end, noting your "business ID" and "location ID".

3) Apply for your state business license.

Through: Washington State Business Licensing Service (BLS)

Uses MyDOR portal.

Click here to go to read more information on the BLS.WA.gov site

Cost: $19 plus $5 for each DBA

Time: 15 - 20 minutes

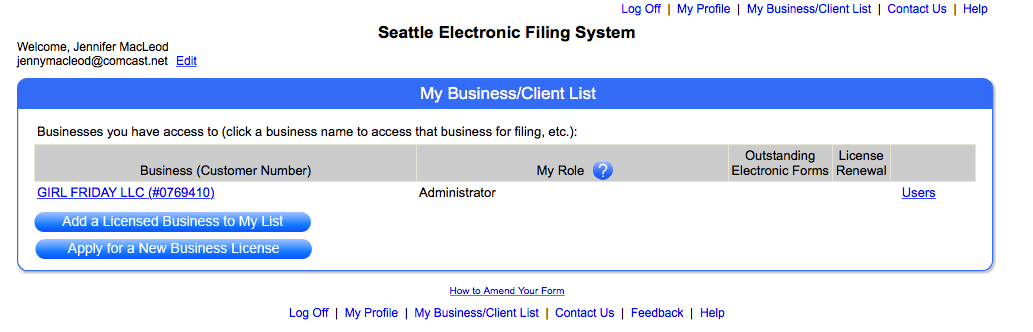

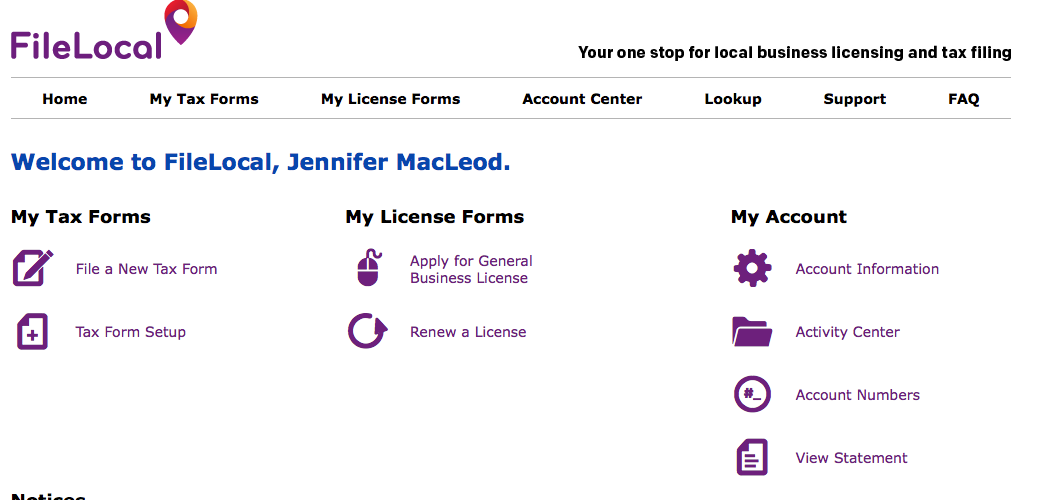

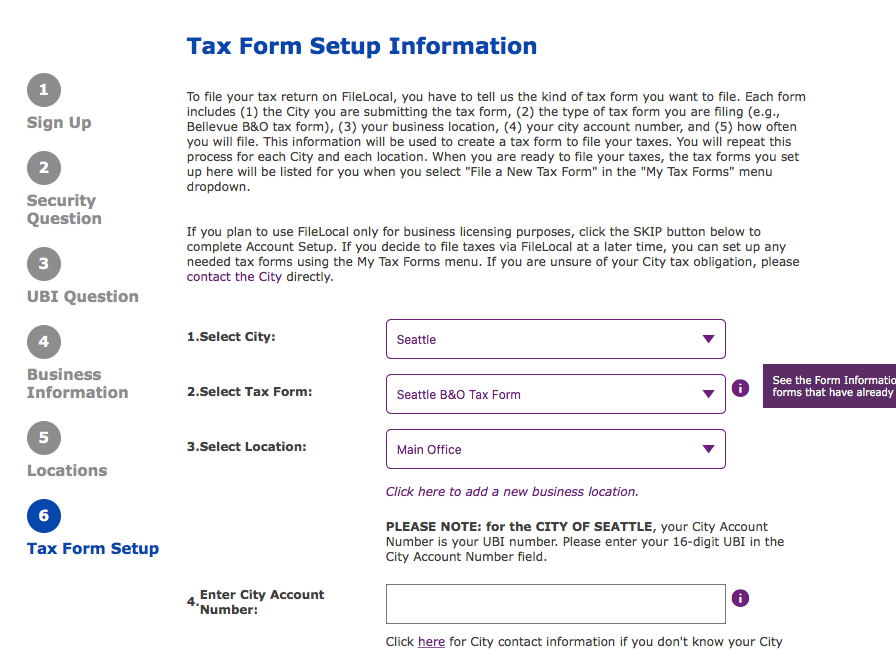

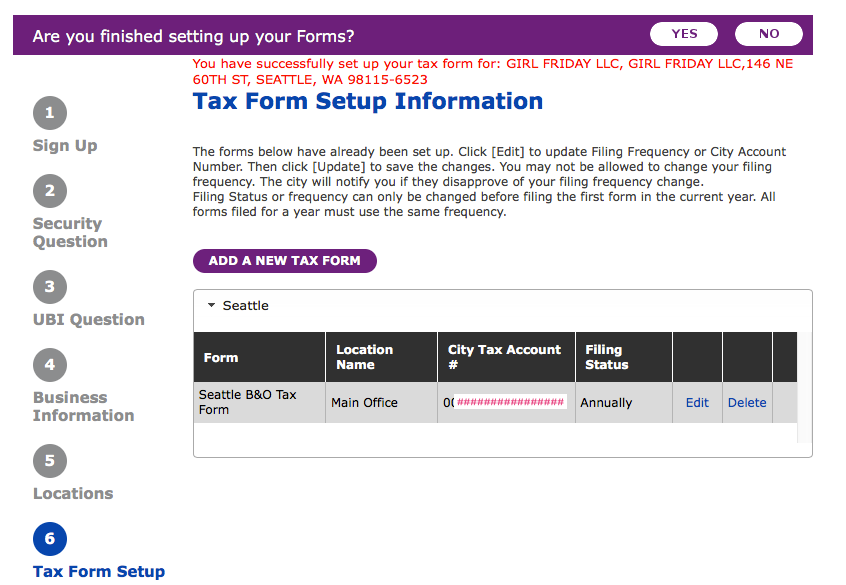

4) Apply for your city business license.

Through: City of Seattle Business Department

Uses the FileLocal Portal.

Click here to read more on the city’s website

Cost: $113 for standard, $56 if you plan to gross under $20K per year.

Time: 15 - 20 minutes

That's it! You're in business. …but you're not quite done. To be legal, you need to ensure that you have all of the special permits and licenses for your line of business.

5) Optional ~ Apply for an EIN

EIN stands for Employer Identification Number. It's a tax ID number assigned to businesses by the IRS. If you are a sole prop or a single-member LLC, you are allowed to use your SSN for business purposes. Having said that, banks and online forms will often required you to have an EIN. The issue is that the number formatting is different. With your social security number, it looks like 000-00-0000. With an EIN, it looks like 00-0000000.

Good news! It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

6) Do your due diligence.

At the state level, check the List of Licenses

This is a list by trade, with links to relevant licensing agencies.

Here's the list of Endorsements required by some businesses.

Or, call the BLS: 1-800-451-7985

And, at the city level, check the Regulatory Endorsements page.

Or, call the City of Seattle: 206.684.2489

Another nice tool is the WA Business Hub. It's created to walk anyone through the setting up a business. There's a TON on there.

7) Celebrate!

* * Please note: The intent of this post is to get you started! And, to provide you with the required framework for every business. Your field may require additional permitting or specialty licenses not covered here. For best results, call the city or state.

Happy Working,

Jenny Girl Friday

Some Helpful Details

With the LLC Registration

Some things you'll be asked:

• the legal name of your company

• 2 alternate names

• start date - day of filing, or a specific date

(Tip: pick one that's easy to remember or has meaning for you.)

• perpetual or specific time period

Mostly, you will have to put your name and address in a million times. Because, as a single-member LLC, you are the member, the manager, the agent, and registrar. You fill all the roles.

Even though you will be a limited liability company, LLCs are handled along with the corporations.

For the State Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• what bank you'll be using

• your SSN and your partner's SSN

• description of your business: 1- 2 sentences

• trade name(s)

• which cities you'll be doing business in (you need a license for each one)

For the City Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• estimated income