UPDATE on 1.7.2025

This requirement is now paused. Here’s a quote from FINCEN:

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports. More information is available at https://www.fincen.gov/boi .

Check back with FINCEN, join the Sidekick Service Newsletter, or email me to stay tuned!

Here is the original blogpost, written in March 2024:

Hi there,

This is a new federal requirement - in 2024 - for anyone who has an LLC / PLLC.

Good news! It’s actually simple and quick and free.

It just looks kinda scary. (And some people in social media try to make it look scarier than it is to get your attention, and try to get money out of you.)

Short Story

You just have to log in, and provide the government with information about your LLC/PLLC and the people who own it. That’s it!

Some Details

The requirement includes filing a BOI Report. This stands for Beneficial Ownership Information. You might also see the acronym BOIR, where the R stands for Report.

If you registered your LLC/PLLC before January 1, 2024 … then you have all year to get it done! For you, it’s due by January 1, 2025

If you registered your LLC/PLLC this year, in 2024 … then you need to complete the BOIR within 90 days of registering your LLC/PLLC.

More of the Story

…Some people use LLCs to cover up criminal activity. So a branch called the Financial Crimes Enforcement Network (FINCEN) is tasked with getting info on all the LLCs/PLLCs and their owners, to verify legal activity. And look for the criminal activity.

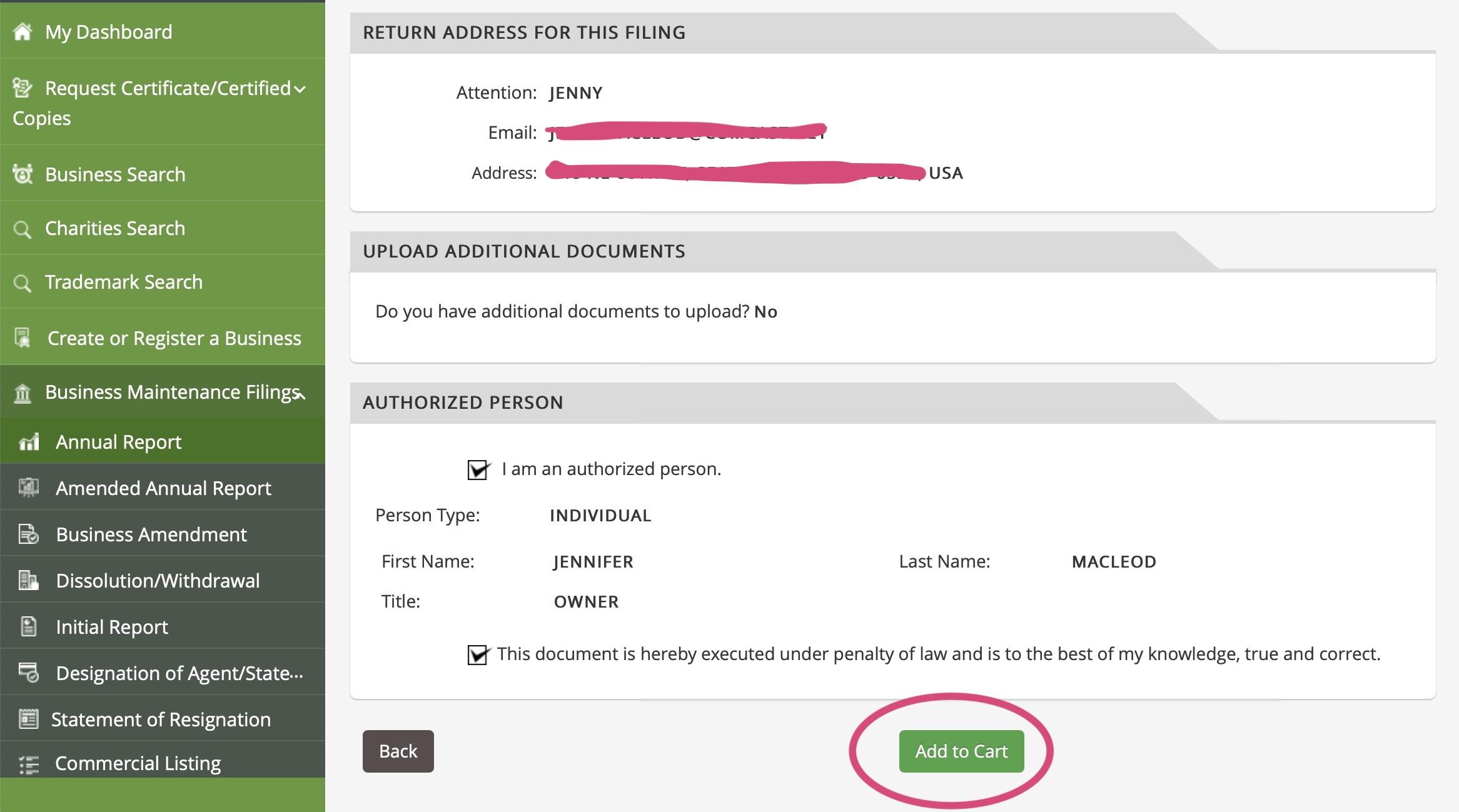

Filing your BOIR

Get prepped:

It’s easy … you’ll just need:

The EIN for your business (or social security number if you don’t use an EIN)

A photo of your Driver’s License or Passport

The process takes 10-20 minutes. (More if you like to read, and re-read instructions!)

Links:

To File Online - Click here

For helpful walkthroughs and screenshots - Click here

ProTips

Question 16 looks a little confusing at first. They’re basically asking if your LLC/PLLC existed before January 1, 2024. If yes, they refer to it as an “Existing reporting company”. If you click Yes to this, you can skip a whole section.

There are little “Need help?” prompts throughout, with more information.

At the end, they’ll offer you a PDF of the report to download. BE SURE TO DOWNLOAD YOUR TRANSCRIPT! Currently, this is the only way to get confirmation that you filed. You’re not able to do it later….

And/or record somewhere that you finished your BOIR. Later this year, there will probably be lots of scary looking ads out there … and your system might get activated. Then, when you remember that you did this, you can feel calm and victorious.

Wishing you a quick and successful filing.

Considering getting a little reward for yourself for dealing with this pesky chore!

♡ Jenny